home office art tax deduction

These materials are generally things you use up within the year think paint clay glaze canvases etc. Instead you multiply the prescribed rate of 5 by the area of your home thats used for business which is.

Can I Take The Home Office Deduction Free Quiz

The maximum deduction under this method is 1500.

. If you have an art studio in your home that you use exclusively for your art business you may be able to deduct the cost using the home office deduction. Each square foot you use for work is worth 5 and you can claim up to 300 square feet for a maximum annual claim of 1500 says Morris. Youll need to own the art for at least one year to be able to write off an increased value and you can write off only up to.

The IRS outlines two ways to claim tax deductions for a home office. These contracts aim to balance your situation with what is allowable by HRMC. Any other artwork for businesses should be written off or claimed as a tax deduction over its useful life at between 1 per cent and 2 per cent of.

The maximum simplified deduction is 1500 300 square feet x 5. Home office art tax deduction Sunday June 5 2022 Edit On April 4 2022 the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID generated by SAMgov. The square meterage of her home office 20m2 in relation to her house 200m2 is 20200 which is 10.

The simplified option has a rate of 5 a square foot for business use of the home. Thanks to some changes to the rules around tax deductions the ATO allows small businesses to claim an immediate 100 tax deduction at the end of each financial year on any. Not be trading stock.

When using the regular method deductions for a home office are based on. To do this calculation multiply the square footage of your home office up to 300 square feet by 5. You need to figure out the percentage of your home devoted to your business activities utilities repairs and depreciation.

During the 2019 financial year it is possible to claim a complete deduction of up to 30000 for each artwork purchased by a small- or medium-sized business for their premises subject to four criteria. Any hard materials you use to make your artwork can be deducted from your taxes. When offloading a piece of art as an investor or art dealer Instead of being taxed at the ordinary income tax rate up to 37 as long as an investor has held the artwork for at least one year it will be just 28 per IRC.

This includes your supplies raw materials electricity that might be used to create your work and frames. Capable of being moved. The maximum size for this option is 300 square feet.

The major advantage of this deduction method is that you dont need to itemize expenses and do complicated calculations. 10 X R 120 000 R 36 000 R 36 000 R 5 000 R 6 666 R 26 366. Each artwork purchased by an eligible business to a value of less than 30000 ex-GST may be eligible for a complete tax deduction subject to four criteria.

The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. We recommend that workers who are claiming home office expenses through a limited company draw up a contract between themselves and the limited company to allow them to claim a deduction on the cost of a home office. However the fact that artworks are held to be depreciating assets by the ATO qualifies art for the instant asset write-off measure.

When you donate art to a not-for-profit organization you typically get to deduct its fair market value at the time of the donation rather than what you paid for it so if the art went up in value while you owned it you could end up with a very large deduction. Therefore Leigh-Anns home office deduction for the tax year. Use form 8829 to calculate your home office deduction and then include that information on line 30 of your form 1040 schedule c profit or loss from business.

Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including Home Office Deduction and Form. If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area. If you use a 6 ft by 8 ft area of your living room to regularly and exclusively run your business then youd multiply 48 6x848 square feet by 5 to get 240.

Purchased with the dominant purpose of display in a business premise. You can also use our handy Home Office Calculator to assist with your workings. In which you dont calculate or allocate actual expenses.

The artwork must be tangible. The artwork must be tangible. Generally the home office deduction is a way to offset the costs of paying for a home office by reducing your taxable income for the year.

This deduction is particularly valuable if you are a renter because it enables you to deduct a portion of your monthly rent a sizeable expense that is ordinarily not deductible. Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction.

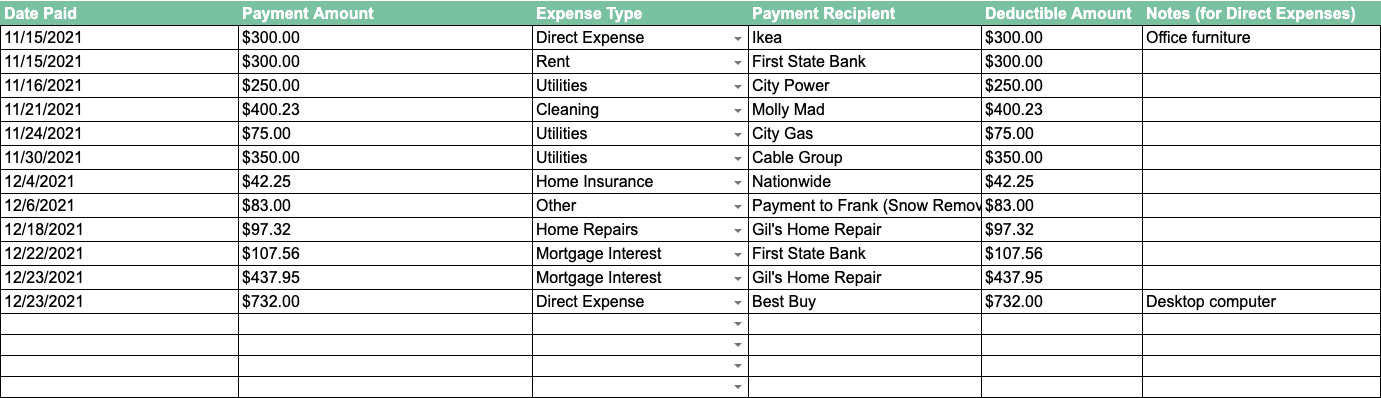

The Best Home Office Deduction Worksheet For Excel Free Template

.png)

Can I Take The Home Office Deduction Free Quiz

Claiming Art As A Tax Deduction 2022 M Contemporary

How Do The Rich Avoid Taxes Billionaires Use This Art Strategy Bloomberg

Tax Return 2022 What Expenses Can I Claim If I M Working From Home Tax The Guardian

Can I Take The Home Office Deduction Free Quiz

Home Office Tax Deductions Faqs Bench Accounting

Can I Take The Home Office Deduction Free Quiz

Claiming Art As A Tax Deduction 2022 M Contemporary

Claiming Art As A Tax Deduction 2022 M Contemporary

The Best Home Office Deduction Worksheet For Excel Free Template

Can I Take The Home Office Deduction Free Quiz

Claiming Art As A Tax Deduction 2022 M Contemporary

Small Business Owners Who Work From Their Homes Can Claim A Tax Deduction For Business Use Of The Home By Using Form 8829 Best Home Office Desk Home Furniture

Tax Deductions For A Home Office Infographic Home Office Home Office Decor Home Office Organization

How Working From Home Affects Income Taxes Deductions 2021 2022

Home Office Tax Deductions For Small Business Nerdwallet

15 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor